Introduction to Cryptocurrencies

Cryptocurrencies are digital or virtual currencies that leverage cryptography for security, making them difficult to counterfeit. They operate on technology called blockchain, a decentralized ledger that records all transactions across a network of computers. This technology is a pivotal component in ensuring the integrity and transparency of transactions. In essence, blockchain creates a secure and immutable record, which is a significant departure from traditional financial systems controlled by central authorities.

The rise of cryptocurrencies has paved the way for decentralized finance (DeFi), a movement that seeks to recreate and improve upon traditional financial systems using blockchain technology. DeFi platforms enable users to lend, borrow, and trade digital assets without intermediaries, thus eliminating unnecessary fees and enhancing accessibility. This shift represents a substantial evolution in financial services, allowing more individuals to participate in various economic activities.

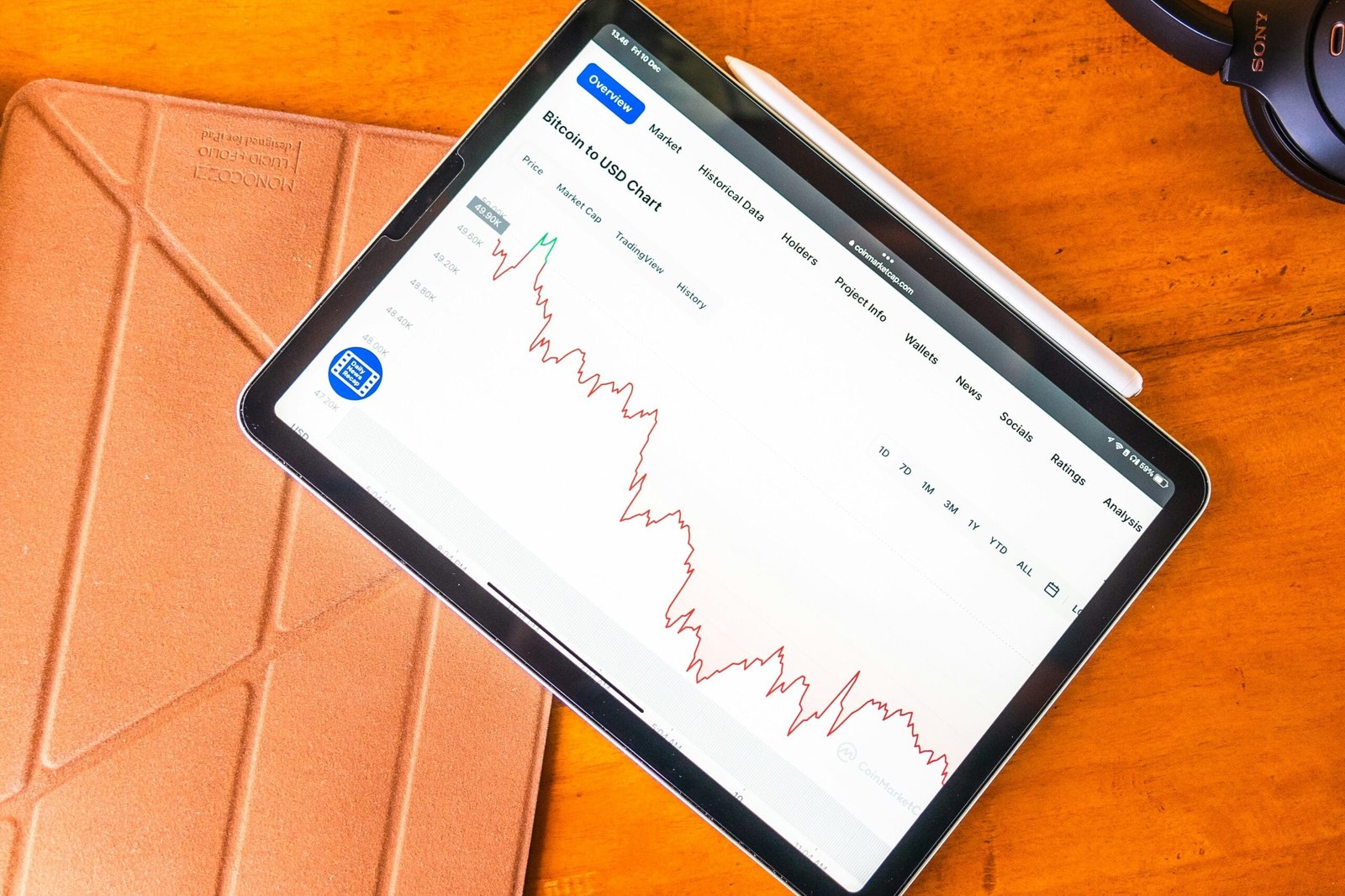

In recent years, cryptocurrencies have gained popularity as an alternative investment vehicle. Investors view them as a hedge against inflation and an opportunity to diversify their portfolios. The market has seen dramatic price fluctuations, leading to significant gains, but also notable losses. This duality underscores the volatile nature of cryptocurrencies, emphasizing the necessity for thorough research and risk management.

The significance of cryptocurrencies in today’s digital economy cannot be overlooked. As more businesses begin to accept cryptocurrencies as legitimate payment options, and as institutional interest grows, the landscape continues to evolve. This burgeoning digital asset class invites both excitement and caution amongst investors and consumers alike. Understanding the fundamental aspects of cryptocurrencies is crucial for anyone looking to navigate the complex world of digital assets effectively.

Criteria for Evaluating Cryptocurrencies

When contemplating investments in cryptocurrencies, it is essential to establish a comprehensive set of criteria to evaluate their viability and potential for growth. One of the primary factors to consider is market capitalization. This metric provides a snapshot of the cryptocurrency’s total value within the market, influencing its liquidity and the level of interest from investors. High market capitalization often indicates a level of stability, but it is important to understand that it does not guarantee future performance.

Another critical aspect to consider is the underlying technology of the cryptocurrency. The technology can influence transaction speed, security, and scalability. For instance, cryptocurrencies built on robust blockchain platforms may offer advantages such as lower transaction fees and enhanced security features. Additionally, evaluating how innovative a cryptocurrency is, especially regarding smart contracts or decentralized finance (DeFi) technologies, can reveal its potential in the crowded marketplace.

Community support is equally vital when assessing a cryptocurrency. A strong community can lead to increased adoption and ongoing development, which are essential for a cryptocurrency’s long-term survival. This can often be assessed through social media activity, developer engagement on platforms like GitHub, and the level of support from influential figures in the cryptocurrency space.

Use cases play a crucial role in determining a cryptocurrency’s relevance and sustainability. A cryptocurrency that addresses real-world problems or offers unique functionalities is likely to have a more substantial presence in the market. Similarly, examining historical performance can provide insights into how the cryptocurrency has reacted to market fluctuations and its resilience during downturns, reiterating its potential as a stable investment choice.

Lastly, regulatory considerations cannot be overlooked. Understanding the legal landscape surrounding cryptocurrencies is vital, as stricter regulations can impact the operation and acceptance of a cryptocurrency. By considering these criteria holistically, investors can make informed decisions regarding the cryptocurrencies they choose to follow or invest in.

The Top 15 Cryptocurrencies in 2023

As the cryptocurrency market continues to evolve, a number of digital currencies stand out due to their market capitalization, innovative features, and real-world applications. Here is a comprehensive overview of the top 15 cryptocurrencies to watch in 2023.

1. Bitcoin (BTC) – With a market capitalization exceeding $900 billion, Bitcoin remains the leading cryptocurrency. Its primary feature is decentralization, allowing users to conduct peer-to-peer transactions without intermediaries. Bitcoin is often viewed as a digital gold, serving as a hedge against inflation.

2. Ethereum (ETH) – Ethereum boasts a market cap of around $400 billion. Its platform enables smart contracts and decentralized applications (dApps), making it a fundamental layer for numerous blockchain projects. With the rollout of Ethereum 2.0, scalability and sustainability are significant focus areas.

3. Binance Coin (BNB) – Initially launched as a utility token for the Binance exchange, BNB has evolved to hold a market cap of approximately $60 billion. BNB is increasingly used in decentralized finance (DeFi) applications, enhancing its adoption beyond trading fees.

4. Cardano (ADA) – With a market cap nearing $40 billion, Cardano emphasizes a research-driven approach to blockchain technology. Its proof-of-stake consensus mechanism is designed for energy efficiency and scalability, which appeals to environmentally conscious investors.

5. Solana (SOL) – Solana has made a name for itself with fast transaction speeds and low fees, culminating in a market cap of around $30 billion. Its ecosystem supports numerous DeFi and NFT projects, showcasing robust real-world use cases.

6. XRP (XRP) – Despite legal challenges, XRP remains a significant player, with a market cap of $20 billion. Known for its focus on facilitating cross-border payments, XRP is integrated into various banking solutions.

7. Polkadot (DOT) – With around $15 billion in market capitalization, Polkadot aims to enable various blockchains to interoperate, enhancing the potential for data and asset transfer across platforms.

8. Dogecoin (DOGE) – Originally created as a meme, Dogecoin’s market cap has surged to $10 billion. It increasingly finds real-world applications, particularly in online tipping and charitable donations.

9. Chainlink (LINK) – Serving as an oracle network, Chainlink has a market cap of $8 billion. It connects smart contracts with real-world data, thus bridging the gap between blockchain technology and off-chain information.

10. Litecoin (LTC) – Known as the silver to Bitcoin’s gold, Litecoin holds a market cap of approximately $7 billion. Its quicker transaction times and lower fees make it a practical alternative for peer-to-peer transactions.

11. Avalanche (AVAX) – Avalanche is recognized for its high throughput and low latency, boasting a market cap of $6 billion. It’s increasingly used in DeFi platforms and offers a unique consensus mechanism that boosts efficiency.

12. Stellar (XLM) – With a market cap of about $5 billion, Stellar focuses on enabling cross-border transactions, particularly aimed at individuals without access to traditional banking services.

13. Uniswap (UNI) – As a leading decentralized exchange (DEX), Uniswap has a market cap of around $4 billion. It allows users to trade Ethereum-based tokens directly, without the need for intermediaries.

14. Terra (LUNA) – Terra, with a market cap of $3 billion, aims to create stablecoins that can be used for a broad range of transactions, ensuring price stability in an otherwise volatile market.

15. Algorand (ALGO) – Rounding off our list, Algorand has gained attention for its focus on speed and security, with a market cap of approximately $2 billion. It is ideal for decentralized applications and financial transactions.

This list not only highlights leading candidates in the cryptocurrency sphere but also showcases innovative features and growing adoption across various industries, indicating a vibrant future for the digital currency landscape.

Future Trends and Considerations in Cryptocurrency

The landscape of cryptocurrency is constantly evolving, and understanding future trends is essential for those interested in this dynamic market. One of the prominent trends to monitor is regulatory developments. Governments around the world are progressively establishing clearer guidelines for digital currencies. This regulatory framework can either bolster the legitimate use of cryptocurrencies or impede growth, making it crucial for investors to stay informed about local and international policies.

Technological advancements, particularly in scaling solutions and interoperability, are also shaping the future of cryptocurrencies. Scaling solutions, such as layer two protocols, aim to enhance transaction speeds and reduce fees. These innovations could facilitate increased adoption by making transactions more efficient and affordable. Additionally, interoperability, the ability for different blockchain networks to communicate and operate seamlessly together, may enable a more cohesive ecosystem, fostering collaboration among diverse projects.

Market sentiment plays a significant role in the future of cryptocurrencies. Investor behavior often fluctuates based on news, trends, and overall economic conditions. Thus, observing public sentiment and its impact on price movements will provide valuable insights for prospective investors. As digital currencies become increasingly integrated into the global economy, their role in various sectors including finance, remittances, and decentralized finance (DeFi) cannot be overlooked. Greater institutional adoption and acceptance by traditional financial systems are anticipated to reshape these dynamics, offering both opportunities and challenges.

In light of these considerations, aspiring crypto experts should remain vigilant and proactive in their pursuit of knowledge. Staying updated with developments in regulation, technology, and market sentiment will be paramount in navigating the complexities of the cryptocurrency landscape in the coming months and years.

Leave a Comment