Investing in cryptocurrency can be very profitable. The crypto market is always changing. Knowing about blockchain technology is key to making smart choices.

Looking to 2025, it’s important to know which cryptocurrencies to invest in. The crypto market is complex. Keeping up with trends and blockchain tech helps investors make good choices.

Investing in cryptocurrency comes with risks and rewards. Knowing the market trends and blockchain tech helps investors. This way, they can make smart choices and get good returns.

Introduction to Cryptocurrency Investment

Investing in cryptocurrency needs a deep understanding of the market and tech. With the right knowledge and strategy, investors can succeed in this complex world. They can reach their financial goals.

Key Takeaways

- Investing in cryptocurrency can be very profitable with big returns.

- Understanding crypto market trends and blockchain technology is crucial for making informed investment decisions.

- Staying up-to-date with the latest developments in blockchain technology can help investors make informed decisions.

- Investing in cryptocurrency requires a deep understanding of the market and the underlying technology.

- With the right strategy, investing in cryptocurrency can be a profitable venture.

- Cryptocurrency investment carries potential risks and rewards that must be carefully considered.

Understanding the 2025 Cryptocurrency Landscape

The crypto market has seen big changes, with new trends and developments. Moving into 2025, it’s key to know the market’s current state and how it’s changed since 2024. The regulatory environment has also been important, with governments setting new rules for cryptocurrencies.

Technological advancements have driven the crypto market forward. Improvements in blockchain and new platforms have made transactions more efficient and secure. This has made cryptocurrencies more attractive to investors and users.

Market Evolution Since 2024

The market has grown a lot, with new cryptocurrencies and more users for existing ones. This growth has made the market more stable and less volatile.

Key Technological Developments

Technologies like artificial intelligence, IoT, and cloud computing have been key. They’ve made blockchain networks more secure and scalable. This has helped the market grow.

Regulatory Changes Affecting Crypto Markets

New regulations have also shaped the market. Governments have set rules to guide cryptocurrency use. These rules have increased trust and made the market more appealing.

In conclusion, the 2025 crypto landscape is influenced by market evolution, tech advancements, and regulations. Staying updated on these areas is crucial for making smart investment choices.

Why 2025 Presents Unique Investment Opportunities

The year 2025 is set to be a key moment for the cryptocurrency market. It offers many investment opportunities that smart investors should not overlook. With market growth expected to keep going, thanks to more people using it and new tech, the chance for big returns is big. The cryptocurrency potential is huge, with new ideas and projects popping up all the time, making it an exciting time to be in the market.

Some key factors make 2025 a great time to invest include:

- More people starting to accept cryptocurrencies

- Clearer rules and guidelines for using them

- New tech that makes them faster and safer

- More interest in DeFi and NFTs

As the market changes, it’s crucial for investors to keep up and adjust. This way, they can make the most of the investment opportunities and handle any risks. With the right plan and a good understanding of the market, investors can reach their financial goals.

Looking ahead, 2025 promises to be a year of big market growth and progress in cryptocurrencies. By being proactive and taking advantage of the investment opportunities that come up, investors can set themselves up for success. They can enjoy the benefits of this fast-changing market.

Essential Criteria for Selecting Profitable Cryptocurrencies

Investors need to look at several key factors when picking cryptocurrencies. A deep market analysis helps spot good opportunities and avoid risks. By checking things like technology, market size, community support, and adoption, investors can do better.

Choosing the right cryptocurrency involves a detailed look at different parts. Technology and innovation are key to a cryptocurrency’s growth. Look for projects with useful ideas and a strong team.

Key Investment Criteria

- Market capitalization analysis to determine a cryptocurrency’s market share and potential for growth

- Community and developer activity to assess a project’s level of support and development

- Adoption metrics to evaluate a cryptocurrency’s real-world use cases and potential for widespread adoption

By looking at these important criteria and doing a deep market analysis, investors can make better choices. This helps them reach their investment goals and understand the complex world of cryptocurrency.

| Cryptocurrency | Market Capitalization | Community Activity | Adoption Metrics |

|---|---|---|---|

| Bitcoin | $1 trillion | High | Widespread adoption |

| Ethereum | $500 billion | High | Increasing adoption |

Bitcoin’s Position and Potential in 2025

Bitcoin is the top cryptocurrency leader in the market. It’s expected to grow even more in 2025. Several things could change Bitcoin’s price, like new tech, rules, and how people use it.

Some important things that could change Bitcoin’s price include:

- More big investors using it

- It gets faster and easier to use

- It becomes safer

Experts say Bitcoin could see a big jump in value by 2025. As the cryptocurrency leader, its success will affect the whole market.

Bitcoin looks strong for 2025, with big growth chances. As the top cryptocurrency leader, it’s set to lead the market and push new ideas in crypto.

| Year | Bitcoin Price | Market Capitalization |

|---|---|---|

| 2024 | $40,000 | $750 billion |

| 2025 (predicted) | $60,000 | $1.2 trillion |

Ethereum and the Smart Contract Revolution

Ethereum leads the smart contract revolution. It makes it easy to build decentralized apps and protocols. With ETH 2.0, Ethereum will get even better, making DeFi grow faster.

ETH 2.0 will make Ethereum faster and handle more stuff. This means we can do more with smart contracts. It opens up new chances for DeFi to grow.

Key Developments in Ethereum’s Ecosystem

- Improved scalability through sharding and off-chain transactions

- Enhanced security through the implementation of proof-of-stake consensus

- Increased adoption of DeFi protocols and applications

Ethereum keeps getting better and will stay important in crypto and DeFi. It focuses on smart contracts and apps. This makes Ethereum a leader in innovation and growth.

| Feature | Description |

|---|---|

| ETH 2.0 | Upcoming upgrade to the Ethereum network, improving scalability and security |

| DeFi Integration | Increased adoption of DeFi protocols and applications on the Ethereum network |

| Scaling Solutions | Technologies and strategies to improve the capacity and efficiency of the Ethereum network |

Top Cryptocurrencies to Buy in 2025 for Profit

Investing in the crypto market can be very profitable. Many top cryptocurrencies offer great investment opportunities. It’s key to look at the chances of each cryptocurrency doing well.

The crypto market keeps changing, with new projects and old ones updating. When picking investment opportunities, think about how much they might grow and the risks.

- Large-cap cryptocurrencies with established track records

- Mid-cap cryptocurrencies with growing adoption rates

- Emerging crypto projects with innovative technologies

By spreading your investments across different top cryptocurrencies, you can grow your wealth. This way, you also reduce the risk in the crypto market.

| Cryptocurrency | Market Capitalization | Growth Potential |

|---|---|---|

| Bitcoin | $1 trillion | High |

| Ethereum | $500 billion | Medium |

| Litecoin | $10 billion | Low |

Always do your homework and keep up with market trends. This will help you make smart investment opportunities in the crypto market.

Risk Management Strategies for Crypto Investing

Crypto investing is both risky and rewarding. To lessen losses, it’s key to use risk management strategies. This means spreading out your investments, setting stop-loss orders, and managing how much you invest in each asset. These steps help protect your money in a market that can change fast.

Effective risk management in crypto includes:

- Doing deep research on what you invest in

- Setting goals that are realistic and achievable

- Keeping an eye on market trends and adjusting your plan as needed

- Viewing crypto investing as a long-term game, not just for quick profits

By using these methods, you can reduce risk and increase your chances of success in crypto investing.

Portfolio Diversification Techniques

Investing in crypto assets means you need to spread your money around. This way, you can lower your risk and increase your chances of making money. It’s all about mixing different investments to protect your money from big swings in the market.

A good mix includes various crypto assets, each with its own strengths and growth potential. This balance helps you manage risk and make smarter choices. For instance, you might choose to invest in both well-known coins like Bitcoin and Ethereum, and newer, more exciting ones.

Benefits of Diversification

- Reduced risk: Spreading your investments across different assets lowers your risk in any one market.

- Increased potential for returns: A diverse portfolio can lead to more opportunities for growth, potentially increasing your earnings.

- Improved investment planning: Diversification helps you make choices that fit your financial goals and how much risk you’re willing to take.

Remember, diversifying your portfolio is not a one-time thing. You should keep checking and tweaking your investments to match your goals and comfort with risk. This way, you can maximize your crypto investments and aim for long-term success.

| Asset | Risk Level | Potential Return |

|---|---|---|

| Bitcoin | Medium | High |

| Ethereum | Medium | High |

| Altcoins | High | Very High |

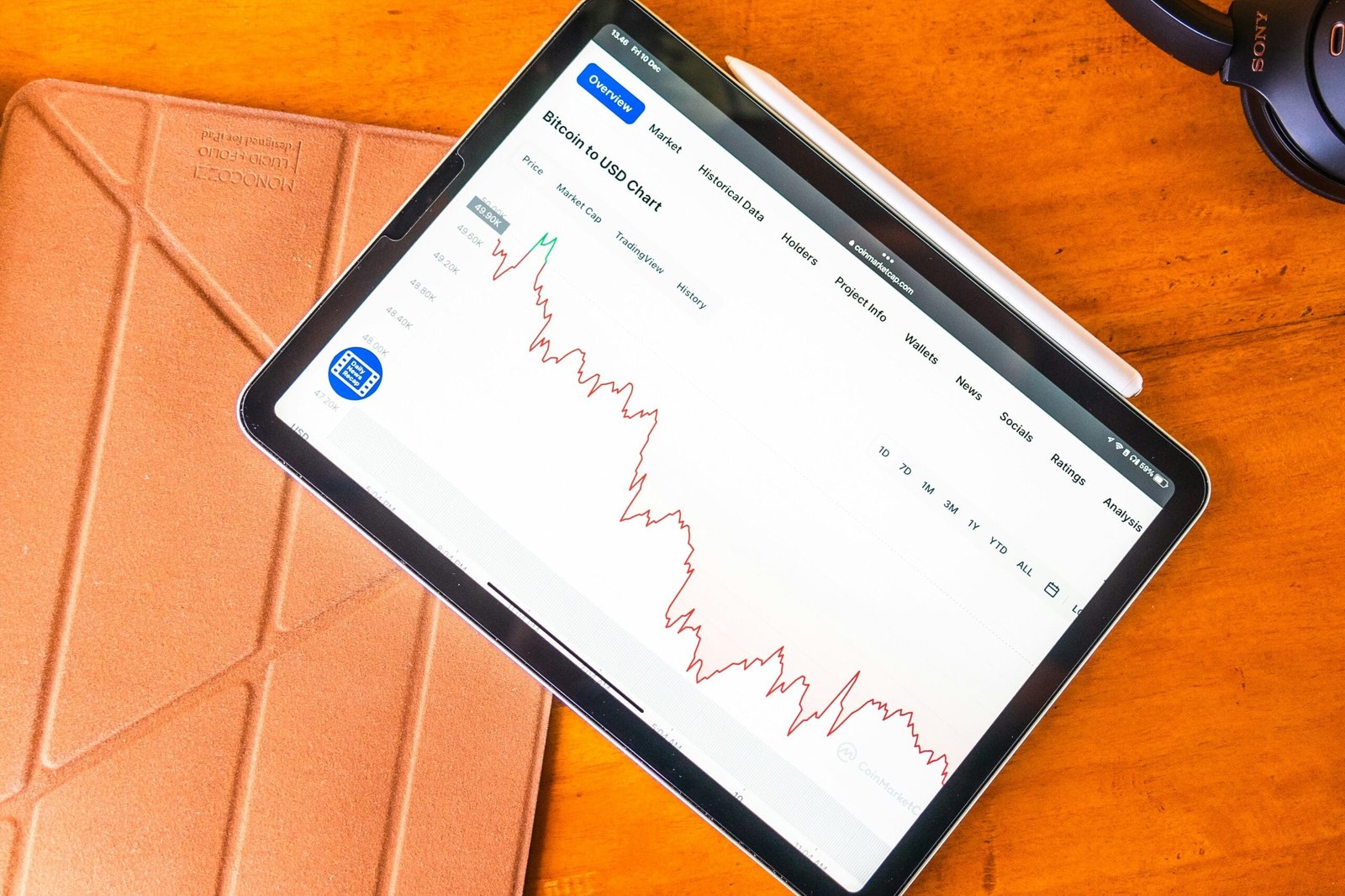

Market Analysis Tools and Resources

Investing in the cryptocurrency market requires good tools and resources. Market analysis tools are key for making smart choices. They help track prices and trends, guiding your investment decisions.

There are many crypto tools out there. They include software for technical analysis, platforms for fundamental analysis, and data providers. These tools offer real-time data and insights, helping you understand the market better.

Here are some top market analysis tools and resources to check out:

- Technical analysis software: e.g., TradingView, Coinigy

- Fundamental analysis platforms: e.g., CoinMarketCap, CryptoSlate

- Market data providers: e.g., CoinMetrics, CryptoCompare

Using these crypto tools and investment resources can help you understand the market better. This way, you can make more informed investment choices.

Common Investment Pitfalls to Avoid

Investing in cryptocurrencies can be rewarding but risky. To make the most money and lose the least, knowing common pitfalls is key. These pitfalls can cause big financial losses if not handled right. It’s important to know the most common crypto mistakes and how to dodge them.

Common mistakes include making decisions based on emotions, not doing enough technical analysis, and ignoring security. These errors can be costly but can be avoided with the right knowledge and strategies. By knowing these pitfalls and taking steps to avoid them, investors can better navigate the crypto market and make smarter choices.

Technical Analysis Mistakes

Technical analysis is vital for investors but can be misleading if not used right. Mistakes include misreading charts and not looking at all the information. To avoid these, investors should thoroughly research and analyze the market. They should look at different views and sources of information.

Emotional Trading Traps

Emotional trading is a big mistake that can lead to quick losses. Investors should be aware of their feelings and manage them. This includes setting clear goals and sticking to a solid plan. By doing this, investors can avoid making rash decisions and stay focused on their long-term goals.

Security Considerations

Security is crucial when investing in cryptocurrencies. Investors should protect their investments by using trusted exchanges, enabling two-factor authentication, and keeping private keys safe. By focusing on security, investors can reduce the risk of pitfalls and keep their investments safe.

By knowing these common pitfalls and how to avoid them, investors can make better choices and increase their gains in the crypto market. It’s vital to stay informed, do thorough research, and prioritize security to avoid mistakes and ensure success in your investment portfolio.

Conclusion: Building Your Profitable Crypto Portfolio for 2025

Exploring the top cryptocurrencies to buy in 2025 shows the crypto market is ready for more growth. Understanding trends, tech, and rules helps investors succeed in 2025.

To make a winning crypto portfolio for 2025, research the market well. Pick promising digital assets, manage risks, and spread your investments. With the right plan and effort, you can make the most of the 2025 market.

The crypto world keeps changing, so keep up with news and adjust your strategy. Always stick to good investment rules. This way, you’ll build a crypto portfolio that could bring great returns in the future.

Leave a Comment